Platinum Prices is back to the 1960s and 1980s peak

Platinum is a dense, malleable, ductile, precious, gray-white transition metal. Its name is derived from the Spanish term platina del Pinto, which is literally translated into "little silver of the Pinto River". It exhibits a remarkable resistance to corrosion, even at high temperatures, and as such is considered a noble metal. It is one of the rarest elements in the Earth's crust and has an average abundance Platinum of approximately 5 μg/kg. It is a transition metal and a member of the platinum group metals (PGM). The catalytic properties of the six platinum group metals – iridium, osmium, palladium, platinum, rhodium, and ruthenium – are outstanding, but platinum has the lowest melting point and is the least dense of them. This unique property of platinum and other platinum group metals account for their widespread use in the chemical and automotive industries.

Sources of platinum production are quite limited. More than 88% of world Platinum production is concentrated in just two countries: the Russian Federation and South Africa. South Africa alone accounts for 75% of as the second biggest supplier at 13%. The six metals of the PGM occur in nature in close association with one another and with nickel and copper. They are among the least abundant of the Earth's elements. Of the few known deposits, those in South Africa and Russia are by far the largest. There are fewer than ten significant pgm miningcompanies in the world.

Platinum in used in a range of industries, but in 2011 around 32% of all the mined supply were used in the automotive industry as the catalyst in automobile catalytic converters with an almost equal amount used in industrial applications. With petrol (gasoline) engine the amounts of air and fuel burnt are usually in chemical balance, there being no excess of either. Under these conditions, and at the quite high temperatures (350-750°C) of the gasoline exhaust gas, platinum and/or palladium oxidise the pollutants carbon monoxide (CO) and hydrocarbons (HC), while rhodium catalyses the reduction of nitrogen oxides (nitric oxide and nitrogen dioxide, termed NOx) to nitrogen. Auto companies, therefore, use catalysts containing platinum and rhodium, palladium and rhodium, or a mixture of all three to meet current gasoline vehicle emissions regulations. These catalytic converters are known as three-way catalysts.

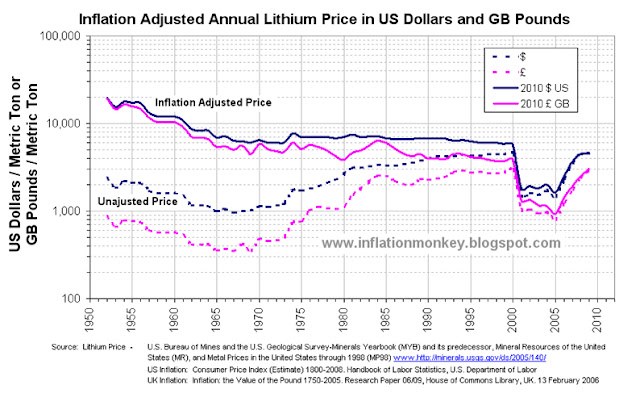

The annual average Platinum price data came from www.kitco.com and it dates back to 1960.

The historical UK Pound to US Dollar exchange rate data came from Lawrence H. Officer, "Dollar-PoundExchange Rate From 1791," MeasuringWorth, 2011 at www.measuringworth.com/exchangepound/. The prices were adjusted for inflation by converting the nominal price into the equivalent in 2011 US Dollars and 2011 GP Pounds Stirling. The US inflation data came from the historical CPI from the US Department of Labor. For the UK inflation the data came from Dominic Webb (2006) "Inflation:the Value of the Pound 1750-2005" Economic Policy and Statistics Section, Research Paper 06/09, House of Commons Library, UK. From this you get the following results shown in the graph below.

|

| Historical Annual Average and Inflation Adjusted Platinum Price since 1960 in Pounds Sterling and US Dollars |

The doted lines are the unadjusted nominal annual average platinum price, and the sold lines are the inflation adjusted platinum price. The first thing that becomes obvious is that the unadjusted palladium price was at its loest in the early 1960s in Dollars and Pounds Sterling at approximately $80 and £30 per a troy ounce respectively.

However when you examine the inflation adjusted platinum price, you notice that its lowest prices was in 1999 in both GB Pounds and US Dollars at around £332 and $511 per troy ounce respectively. Since them the price peaked in 2010 at approximately £1,184 and $1,798 per troy ounce respectively, where upon it dropped back to slightly 2011. In US Dollar, the inflation adjusted price peak in 2010 was very similar to the value of the previous peaks in 1968 and 1980. On the other hand when priced in Pounds Starlings the inflation adjusted price peak in 2010 was very close to that in 1980 but not 1968, which was larger, which can be easily seen in the chart below showing only the inflation adjusted platinum price with a linear axis (non logarithmic, unlike the first chart).

The inflation adjusted price bottomed in 1998 at $514 and £324 per troy ounce respectively. Coincidently this was the year before the palladium priced peaked. It is interesting to note that between 1960 until 1985 the inflation adjusted price bottomed at around $500 in Dollars and in the region of £460 to £560 in Pounds Sterling. The all-time peak inflation adjusted price occurred in 1980 in US Dollars at approximately $1,850, but occurred in 1968 in UK Pounds at approximately £1,520 per troy ounce. When priced in Dollars, there were 3 peaks in the inflation adjusted price, 1968, 1980 and 210. However when priced in Pounds there were only 1 occasions it peaked, 1968. There next 2 highest peaks occurred in 1980 and 2010 at approximately £1,000 and £1,200 respectively (which are 33% and 21% lower then the peak in 1968).

Using the price in 1971 as a baseline the inflation adjusted platinum price in UK Pounds and US Dollars was indexed and this is shown below.

However when you examine the inflation adjusted platinum price, you notice that its lowest prices was in 1999 in both GB Pounds and US Dollars at around £332 and $511 per troy ounce respectively. Since them the price peaked in 2010 at approximately £1,184 and $1,798 per troy ounce respectively, where upon it dropped back to slightly 2011. In US Dollar, the inflation adjusted price peak in 2010 was very similar to the value of the previous peaks in 1968 and 1980. On the other hand when priced in Pounds Starlings the inflation adjusted price peak in 2010 was very close to that in 1980 but not 1968, which was larger, which can be easily seen in the chart below showing only the inflation adjusted platinum price with a linear axis (non logarithmic, unlike the first chart).

|

| Historic Inflation Adjusted Platinum Price since 1960 in US Dollars and Pounds Sterling |

|

| Historical Inflation Adjusted Platinum Price since 1960 in US Dollars and GB Pounds, Indexed to 1971 |

The indexed price data clearly displays that the historic inflation adjusted platinum prices has been considerably volatile since 1960. In fact the most stable period for the price in both US Dollars and UK Pounds, was during the 1990s. The annual average price in US Dollars in 2011, was within 93% of the inflation adjusted peak prices of 1980. So in reflection platinum is very expensive in US Dollars relative to its historic inflation adjusted price, but only moderately expensive when priced in Pounds.

Written by Inflation Monkey. Join on Google+.