Historical Inflation Adjusted Nickel Price since

1900 in Pounds Sterling and US Dollars

Nickel is

used in many industrial applications and sectors, from a corrosion resisting

additive in steel to elements in batteries and catalyst for hydrogenation. This

makes it an important commodity to examine its historic price and inflation adjusted

price.

The annual average copper price data since 1900 to

2010 came from the US Geological Survey. The historical UK

Pound to US Dollar exchange rate data came from Lawrence H. Officer,

"Dollar-Pound Exchange Rate From 1791", MeasuringWorth, 2011 at

www.measuringworth.com/exchangepound/. The prices were

adjusted for inflation by converting the nominal price into the equivalent in

2011 US Dollars and 2011 GP Pounds Stirling.

The US

inflation data came from the historical CPI from the US Department of Labor. For the UK inflation

the data came from Grahame Allen (2011) "Inflation: the Value of the Pound1750-2011" Economic Policy and Statistics Section, Research Paper 12/31,

House of Commons Library, UK. From this you

get the following results shown in the graph below.

|

Historical Annual

Average and Inflation Adjusted Nickel Price since 1900 in US Dollars and UK

Pounds

|

The doted

lines are the unadjusted nominal annual average nickel price, and the sold

lines are the inflation adjusted nickel price.

The first feature that becomes obvious is that the unadjusted nickel price

was at its lowest in the in 1924 in both US Dollars and Pounds Sterling at

approximately $661 and £150 per a metric tonne respectively. Furthermore before 2007 the nominal price

peak occurred in 1988 to 1989 in both US Dollars and UK Pounds at approximately

$14,000 and £8,000 per a metric tonne respectively.

However when

you examine the inflation adjusted nickel price, you notice that its lowest

prices occurred in 1998 in both US Dollars and UK Pounds at approximately $6,400

and £3,965 per metric tonne. The closed

the inflation adjusted price came to those lows in both currencies, occurred in

the mid 1920’s, late 1940’s and 1985. The

highest inflation adjusted price happened in 2007 in US Dollars and Pounds

Sterling at $44,450 and £20,968 respectively.

The historic

inflation adjusted nickel prices in US Dollars and UK Pounds can be more easily

seen in the chart below, which only shows the inflation adjusted price on a

linear axis (non logarithmic, unlike the first chart).

|

| Inflation Adjusted Nickel

Price since 1900 in US Dollars and Pounds Sterling |

As it came

bee seen the general trend in the inflation adjusted nickel prices showed a steady

decrease from 1900 until the early 1920’s, were upon it stayed fairly constant until

it decreases slightly to reach one of its lowest prices in the late 1940’s. From then it rose back to the average price seen

the 1920’s and remained relatively stable until the late 1960’s. In the late 1960’s the inflation adjusted

price rose rapidly by over 30% and fluctuated around this new prices for much

of the 1970’s. In the late 1970’s and

early 1980’s the price consistently dropped until it bottomed in 1986 at an

inflation adjusted price close to that in the late 1940’s.

In the late

1980’s the nickel price exploded in just a few years to reach equal the inflation

adjusted high not seen since the early part of the 20th century at $26,300

in US Dollars. In UK Pounds Sterling the

price peak in the 1980’s only reached the inflation adjusted price seen the

1970’s at £17,000, because of the strength of the Pound relative to the Dollar.

In both US Dollars and Pounds Sterling

the nickel price dropped back in the late 1990’s and early 2000’s. In the late 200’s the price rocked as it did

in the mid 1980’s to reach an all-time inflation adjusted price of $40,500 and

£21,000.

Using the

price in 1900 as a baseline the inflation adjusted nickel price in UK Pounds

and US Dollars was indexed. This allows

the examination of the relative price changes during this historical period of

time more easily and is shown below.

|

| Historical Inflation

Adjusted Nickel Price since 1900 in US Dollars and GB Pounds, Indexed to 1900 |

The indexed price

data clearly displays that the historic inflation adjusted nickel price has been

volatile and had not dropped like the inflation adjusted aluminium price had

done. By the late 1990’s

and early 2000s the nickel price dropped to between 30 to 40% of the price of

what it was in 1900. The all-time low occurred

in the late mid 1920’s, late 1940’s and mid 1980’s. The current nickel price by the beginning of

2011 is comparable to the inflation adjusted prices in the late 1970s, which is

slightly higher than the average since the beginning of the 20th century.

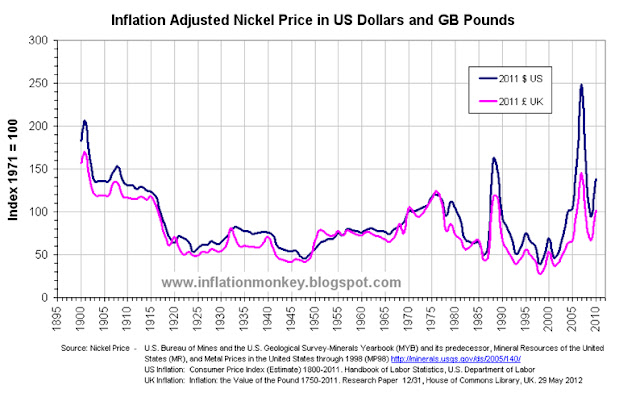

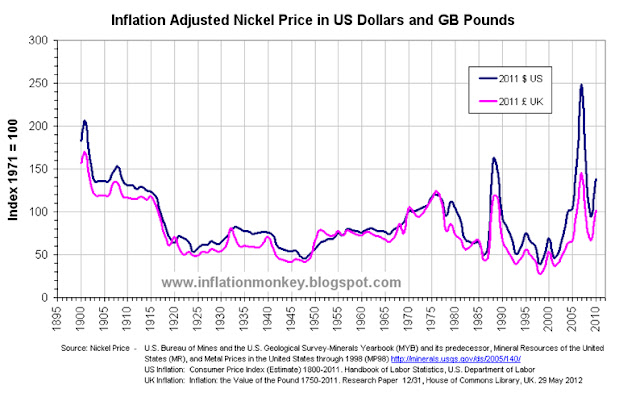

This is easier to see from the graph

below where the inflation adjusted price is indexed to that in 1971.

|

| Historical Inflation

Adjusted Nickel Price since 1900 in US Dollars and GB Pounds, Indexed to 1971 |

So from a

historical perspective once inflation has been accounted for, the price of nickel

is comparable to the peaks seen in the late 1970s. This begs the question, as nickel is used in

so many industries and industrial applications, does this means the developed

economies are due to repeat the economic difficulties that were experienced in

the 1970s?